What did I hear at IEOC? Part 3

One of the really nice features of the IEOC format is that breakouts are organized by specific markets and presented by segment experts. The good news is that all of the presentations are very informative. The only inconvenience is that I can only be at one session at a time, The slides, however are available to all attendees so we can review the sessions that we missed.

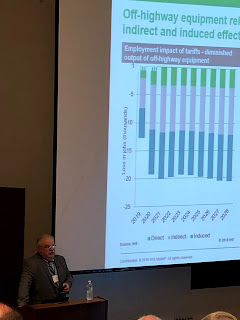

Scott Hazelton of IHS Markit gave a presentation titled Industry Markets Overview. Since the three main segments of the fluid power industry are industrial hydraulics, mobile hydraulics, and pneumatics, this presentation is a pretty significant part of the conference.

Scott Hazelton of IHS Markit gave a presentation titled Industry Markets Overview. Since the three main segments of the fluid power industry are industrial hydraulics, mobile hydraulics, and pneumatics, this presentation is a pretty significant part of the conference.

Here are my notes. There will be a 0.3% growth in the industrial sector for 2019 and a 1% growth for 2020. This would still allow for a dip in the first half and a pick up in the second half of 2020 with a net gain of 1%.

Natural gas prices will be down 16% in 2019 and down 7% in 2020. The PMI will show a slight rebound currently. The building industry is flat-to-slightly-down but consumer sentiment is on the way up. Imports make up 60% of industrial machinery with China declining by 45% this year. U.S. exports of machinery to china has declined by 12%

Oil prices are down 9% and the near future pricing for barrel of oil should settle at around $62 to $63 with global demand lower than expected for 2019. The U.S. rig count continues to drop and the U.S. ship and boat industry is flat to down 1% because of overcapacity.

Overall, the outlook is weak. Tax stimulus has ended and tariffs have put many investments on hold. The strengthening of the dollar has hurt exports.

That is my takeaway. I wish that I could write faster.